Table of Content

Devotes much of its business to serving military families with VA loans. Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. Here is a list of our partners and here's how we make money. We believe everyone should be able to make financial decisions with confidence. We use intelligent software that helps us maintain the integrity of reviews.

Certain alternative lenders may be willing to accept borrowers with a limited credit history or a poor credit score. Minimum credit requirements aren’t always listed on a lender’s website, but shopping around and prequalifying could help you find a loan that fits your needs. Within each category, we also considered several characteristics, including loan amounts, repayment terms, APR ranges and applicable fees. We also looked at whether each lender accepts co-signers or joint applications and the geographic availability of the lender.

Tips To Improve Your Credit Score Before Buying

Specializes in personal loans for bad credit and programs to build or improve credit. Borrowers should consider Upstart if they have extremely low credit scores or no credit histories at all. Its personal loans are available for $1,000 to $50,000, with rates ranging from 5.6% to 35.99% APR.

The approval will require the borrower to meet other income and financial criteria. Homebridge Financial Services is a privately held non-bank mortgage lending firm that services loans across the United States. The minimum credit score accepted varies based on loan type, but certain government-backed loans can be approved with a credit score as low as 550.

Types of loans

If you can’t qualify on your own, you might add a co-signer to your application to boost your chances of approval. A co-signer is legally responsible for your debt; if you can’t make your payments, your co-signer is responsible for paying off the loan. If you must turn to private loans and you have bad credit and no co-signer, lenders that consider factors beyond credit are your best choice. Look closely at fees and interest rates, which are often higher than what federal loans charge. It’s best to compare the overall loans’ costs by getting prequalified on the lender’s websites if they allow you to. If you have a very high GPA or high future income potential, a student loan that qualifies you based on major and academic performance could be a strong option.

You may also consider taking out a credit-builder loan, typically available at credit unions and online lenders. The lender will place the money you’ve borrowed in a savings account that accrues interest. You’ll make payments toward the account each month and have access to the funds when your loan term is over. Some borrowers may need additional funding beyond what federal loans provide.

Ways to Improve Your Credit Score Before Borrowing

Eligible borrowers can qualify for a loan with little to no down payment, and borrowers may qualify for interest rate discounts. Of the lenders on this list, SWBC had the quickest average closing time. According to the lender, most loans close in under three weeks, so you can move into your dream home sooner. Kat Tretina is is an expert on student loans who started her career paying off her $35,000 student loans years ahead of schedule.

If you don’t have strong credit, you may not get approved or you may only qualify high interest rates. However, student loans could have a negative impact on your debt-to-income ratio . Lenders use your DTI to see how much of your income goes towards paying off debt each month. The lower your DTI, the more attractive you will be to future lenders. If there is a trusted person in your life who is willing to co-sign a private student loan for you, that could help you qualify for a loan with lower interest rates and fees.

Borrowers should also be aware that there is an origination fee of up to 7% for each loan, and late fees and insufficient funds fees are $15 for each instance. However, some reviewers complained about high origination fees and poor customer service after receiving their money. If youre offered a mortgage only at a very high interest rate. Youll make higher monthly payments, and your loan will cost more over time than if you can wait until your credit improved enough to get a better deal. When shopping for a mortgage, consider the credit requirements, interest rate, fees, loan size, loan term, rate adjustability, and required down payment.

Credit score that's as low as 500, you would need to be able to make a 10% down payment — and you probably wouldn't get a great interest rate. Offers government-backed mortgage options for low- to moderate-income borrowers. Watermark offers conventional loans with as little as 3% down. Know, however, that there are two main credit scoring models, FICO and VantageScore, and several versions of your credit score; these companies release new scoring algorithms regularly.

SWBC offers multiple loan products, including government-backed options like FHA loans, VA loans, and USDA loans. In addition, SWBC offers jumbo loans, conventional loans, and renovation mortgages. Since its inception, the lender has originated over $78 billion in loans. Cherry Creek issues loans in 41 states, but borrowers cannot apply online; you have to work with a loan officer to get details about rates and fees and submit a loan application. Cherry Creek has a range of other mortgage products, including those with down payment requirements as low as 3%.

So make sure you shop around and ask about different lenders’ policies. Bad credit doesn’t necessarily mean you won’t qualify for a mortgage. Technically, there’s no minimum credit score requirement for a VA loan. However, most lenders impose a minimum score of at least 580. FHA loans have the lowest credit score requirements of any major home loan program. Most lenders offer FHA loans starting at a 580 credit score.

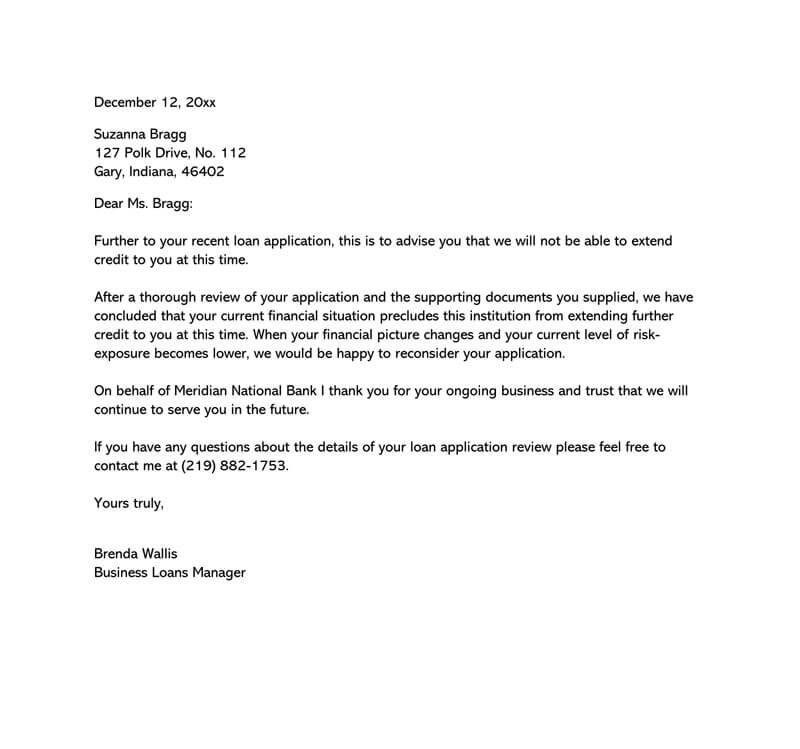

In addition, even though it provides relief in case the person's credit history could be more stable, keep in mind that negative credit loans should not be used regularly. Given their high cost, they are also not a viable alternative for completing more significant decisions or purchasing inconsequential things. There can be any number of factors for you to have a loan from the bank to be rejected. However, your needs will only be met if you have a loan approved by the bank.

While it might cost more in the short term to get your finances organized and paid off, a better credit score saves thousands of dollars over the life of a mortgage. Homeownership remains an attractive goal for many Americans, but you may feel the dream is out of reach if you have a lower credit score. While buying a home with bad credit is more challenging, it’s not impossible.

No comments:

Post a Comment